Nerd alert ahead. Practical tips to follow.

I think it’s safe to say that 2020 is not turning out like any of us expected or hoped. When difficult times are upon us, it’s the most human thing of all to wish it had all happened differently (or to someone else).

There’s a quote that sums up the feeling pretty well.

In Tolkien’s The Lord of the Rings, Frodo (the unlikely hero) must lead a small group to overcome an extraordinary threat to the world (sound familiar?).

When he despairs of the dangerous journey ahead of him, Gandalf (the wise wizard) responds with a valuable lesson:

“I wish it need not have happened in my time,” said Frodo. “So do I,” said Gandalf, “and so do all who live to see such times. But that is not for them to decide. All we have to decide is what to do with the time that is given us.”

I feel like Frodo some days. Wishing I didn’t live in such times. Do you?

But here we are. All we can do is decide what to do with what we can control.

We are in uncharted waters and it’s increasingly clear that this is an economic downturn that could rival the Great Recession in its severity.

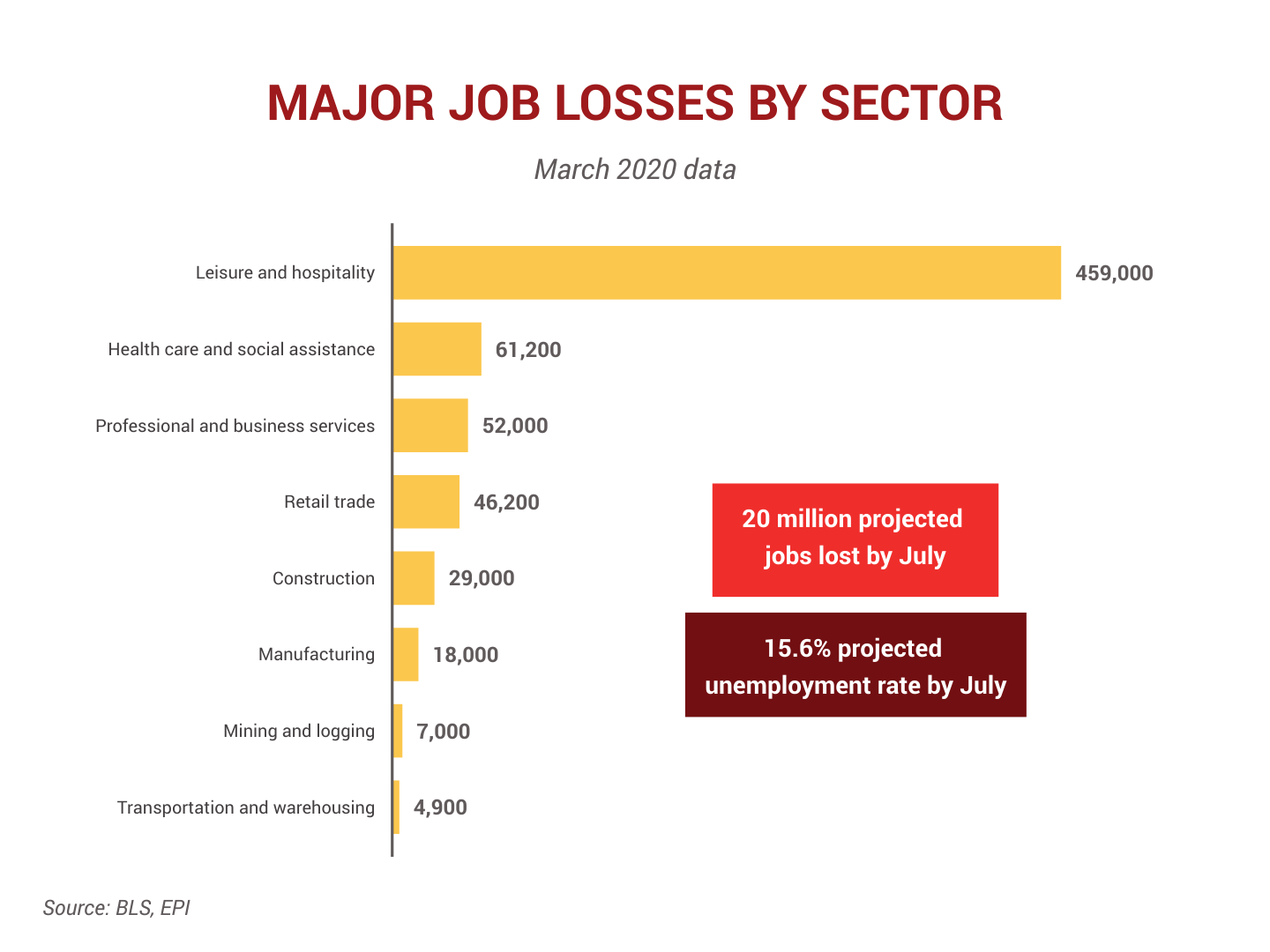

I don’t say this to be alarmist, but to share the information I’m using to plan for my clients and help you use it effectively. The labor market is giving us a near real-time view of how the coronavirus is affecting the economy, and we can see that more disruption is likely as businesses lay off workers.

Behind each point in this chart are actual people who have lost their jobs or seen their income cut dramatically. Like Suzana Davila & the folks at Cafe Poca Cosa, who make the best chicken mole in Tucson, and the owner of the lovely AirBNB I stayed at in Bisbee for my son’s birthday, and practically the entire town of Tombstone, Arizona, home of the OK Corral and other tourist attractions.

They’re all real people facing income shortfalls and dreams deferred. While the shutdown is necessary to stem the tide of infection, it’s really going to hurt.

Fortunately, there are signs that coronavirus-related legislation (like the CARES Act) will help blunt the worst effects by giving support where it’s needed. And I think it’s likely that further aid will follow once policymakers see the depth and breadth of the economic damage.1

Now on to the practical advice you can use (and share) right now.

More layoffs and furloughs are coming. If you think you might lose your job or face a reduction in income in your family, let’s plan ahead for it and revisit your emergency funds and cash flow. The CARES Act opened up some additional options that we can discuss together.

RMDs have been waived for 2020. If you don’t need the cash this year, consider skipping the distribution or turning it into a Roth Conversion. If you already took some or all of your 2020 RMD after February 1, you may be able to return it to your account as a rollover through July 15 (as long as you didn’t complete another rollover within the last 12 months).2 There’s some fine print to this, so please reach out if you’d like guidance.

Tax and IRA contribution deadlines have been extended to July 15. The IRS extended the 2019 tax filing deadline for any taxpayer who had to file by April 15. The extension also covers 2019 IRA contributions.3 Very important: if you’ll be making a last-minute 2019 contribution on your own, make sure the check or deposit is clearly marked 2019 to avoid an administrative error.

Stimulus checks will start arriving soon. If you had direct deposit information on your last tax filing, the IRS should send your check to your account. If you didn’t (or the account is closed), the check would go to the address the IRS has on file for you.

Small business owners should act fast on loans. The Paycheck Protection Program is offering forgivable, collateral-free loans through June 30, but the money is going quickly. SBA Express Loans and Economic Injury Disaster Loans are also options to consider.4 Though it’s not yet clear how long it will take to actually receive the loan funds, it’s smart to get your paperwork together and file quickly. Please reach out if you need help reviewing your options.

Some student loans can be deferred. Under the CARES Act, no payments are due on federally held loans through September 30, and no interest will accrue. Unfortunately, private student loans (or those held by a lender other than the Department of Education) are not currently eligible.5 Very important: I’m seeing mixed information on whether payments will pause automatically, so check in with your servicer.

You could get more from Medicare. Medicare has made some important updates to its coverage due to the crisis. Telehealth benefits are expanded, so you may be able to see your doctors over the phone or online. Many plans have relaxed their definition of “in-network” providers, so it’s worth checking with your plan. Part D recipients can now request 90-day supplies of medication instead of the usual 30-day supply to help avoid trips to the pharmacy.6

We can’t control what happens next, but we can control some things: our choices, our behavior, and our mindset.

I’m no Gandalf, but I hope I can help lighten your load in these troubling times. I don’t know what the coming weeks and months will bring, but I do know this: we’re in it together. And we’ll get through it together.

If you’d like help acting on any of the tips above, or just want to talk through some strategic moves, please reach out. I’m here.